What Is W-2 Form? Comprehensive Guide

The W-2 form is a crucial document that helps workers explain their wages and file tax returns accurately. It’s also used for tax withholding verification alongside Medicare and Social Security records.

Understanding the form empowers employers and workers to manage their financial responsibilities properly. So here’s a breakdown of principal considerations regarding the W-2 form definition, purpose, and the information it contains.

Let’s begin!

What Is W2 IRS Form?

W2, or Wage and Tax Statement, is a legal document that has to be sent to the workers and the Internal Revenue Service at the end of each calendar year. The purpose of a W2 form is to report employees’ annual earnings and the amount of state, federal, and other taxes withheld from their paychecks.

Components of W-2 Form

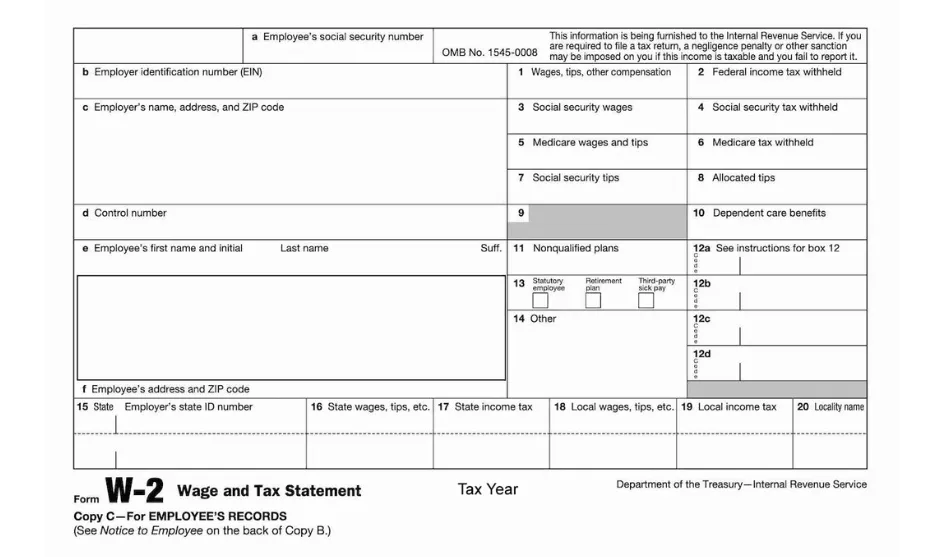

The W2 form serves as a structured depiction of an employee’s financial year and ensures compliance with Internal Revenue Service (IRS) regulations on reporting their income and the amount withheld. The form is made up of lettered and numbered boxes:

- Boxes a-f: basic information about the employer and employee (name, ZIP code, and address, employee’s SSN, and employer’s identification number).

- Boxes 1-2: salary, tips, and other forms of worker compensation (taxable fringe benefits, bonuses, etc.) an employee was taxed on, as well as the amount of federal income tax withheld.

- Boxes 3-6: the total amount of earnings subject to Medicare and Social Security taxes and the portion of taxes withheld.

- Boxes 7-8: any tip income reported by a worker and the amount subject to be withheld.

- Box 9: must be left empty.

- Box 10: dependent care assistance a worker received from their employer, if applicable.

- Box 11: deferred compensation a worker received in a nonqualified plan.

- Box 12: other types of compensation and deduction from taxable income denoted with single- or double-letter codes, which are specified in the general W-2 form instructions.

- Box 13: contains three checkboxes to show the statutory employee status, third-party sick pays, and retirement plans.

- Box 14: additional tax data that does not fit into other W-2 form sections (e.g., union dues or disability insurance).

- Boxes 15-20: earnings subject to local and state taxes and the amount that was withheld.

W-2 Form Copies Explained

W-2 form comes in a package of six copies, each of which has its function in the process of tax reporting:

- Copy A: filed with the Social Security Administration by the employer, with the W-3 form attached.

- Copy B: sent to the employee for further filing with their federal tax return.

- Copy C: sent to the employee for their personal records.

- Copy D: kept by the employer for their business records.

- Copy 1: kept by the employer for further filing with the city or state tax agencies if required.

- Copy 2: sent to the employee so they can file it with the city or state tax department if there is such a request.

How Does W2 Work?

An employer fills out a separate W2 for each worker they have paid throughout the year (excluding independent contractors) and then submits all the forms to the Social Security Administration alongside a W-3 form. After the SSA processes the documents, it reports the relevant federal tax information to the Internal Revenue Service. The employer must also send W-2 copies B, C, and 2 to the employees in either digital or paper form.

When Do You Normally Get Your W2?

All the forms must be distributed to workers by January 31st, and the timeline applies to both electronic and paper filings. Otherwise, the employer may face fines and penalties from the IRS. If you do not receive your form, reach out to your employer to find out how they sent it out and how you can get the document. If W2 was mailed to the wrong address, they can issue you another copy directly.

How to Fill Out W-2 Form?

W-2 forms are processed by machine, meaning that script, handwritten, or italicized entries are discouraged. All the data must be in black ink and preferably in a 12-point Courier font. Moreover, it’s crucial to indicate dollar entries without the ‘$’ sign and use the decimal point instead of a comma (0000.00).

It’s possible to find and download a W2 form through the IRS website or submit it with the SSA. Top-quality document management tools, like PDF Guru, give access to the blank W2 form 2024 PDF, too, as well as allow you to fill it out conveniently, ensuring it complies with IRS requirements.

Final Thoughts

With its detailed account of yearly employee income and tax contributions, the W-2 form is crucial for transparent financial reporting. By sorting out how it works, you equip yourself with valuable knowledge to navigate the tax season smoothly. If you have additional questions regarding the form, you can call a free IRS helpline at 800-829-1040.