Silver Price FintechZoom to Track Silver Market -A Guide for Investors

Silver, a precious metal with a long and illustrious history, continues to draw investors looking for growth potential and stability. Making wise investment decisions requires an understanding of price variations. Staying educated is very important for buyers who want to make it through the complicated silver market. Then FintechZoom comes in.

Silver price FintechZoom steps in, providing useful resources and analysis to help navigate the silver market and make wise investment decisions.

In this blog post, I will explain why you should consider Silver price FintechZoom when investing in silver.

Let’s start!

Silver Price FintechZoom – Your Companion in the Silver Market

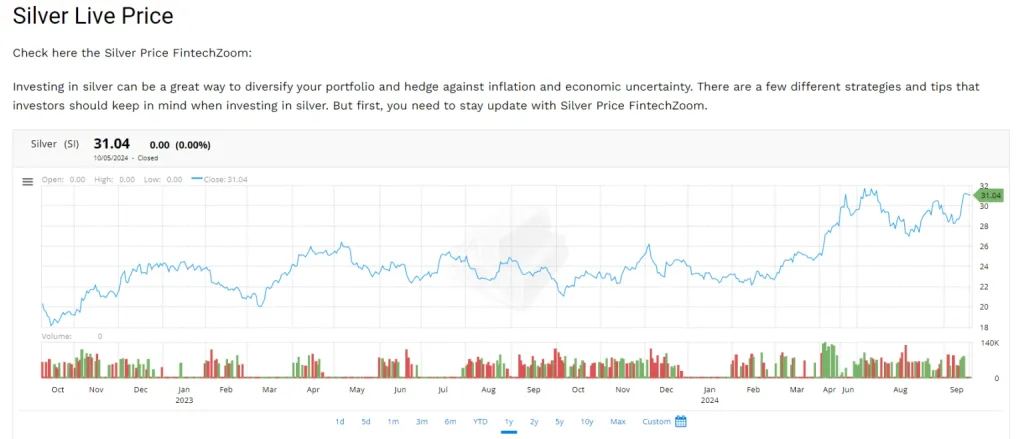

Silver Price FintechZoom is a platform providing real time silver price and other features to empower silver investors and those interested in tracking the Gold Price FintechZoom or broader indices like FintechZoom SP500.

Fintechzoom.com silver price chart provides live updates on silver prices, which are essential for timing your trades or purchases. Let’s see how this platform helps investors:

Real-time Silver Prices:

With fintechzoom com silver price prediction, investors stay informed about the constantly shifting market. Analyzing previous price trends can provide important insights by pointing out tendencies and helping you make wise predictions. With FintechZoom’s charting tools, you can see price movements across a range of timeframes.

Professional Opinion:

Gain from the experience of professionals in the field who give their insights and observations about the silver market. These observations can offer insightful viewpoints on the state of the market now and possible directions for future growth.

News and Trends in the Silver Market:

Keep up with the most recent events and news that could affect the price of silver. Silver price FintechZoom offers customized alerts based on your interests or carefully selected news feeds. By doing this, you can be sure that you are always up to date on updates that could affect your investing choices.

Using Silver Price FintechZoom to Make Wise Investments

FintechZoom’s features can help you become a more knowledgeable silver investor:

Determine Entry and Exit Points

To ascertain the best times to purchase and sell silver, it is important to examine past trends, professional opinions, and current price changes. You can improve your chances of making good trades by taking into account elements like silver technical indicators, silver price fintechzoom chart graph, and the general sentiment of the market.

Risk Management

To minimize possible losses and make well-informed judgments, make use of historical volatility data, market research, and real-time price updates. FintechZoom also delivers stop-loss orders, a risk management tool that instantly liquidates your silver investments in the event that the price drops below a preset threshold.

Remain Ahead of the Trends

You should keep yourself updated on market trends at Silver Price FintechZoom. It adjusts your investment strategy accordingly. To capitalize on future opportunities, it is important to understand the factors that influence silver prices. These factors include geopolitical events, economic circumstances, and industrial demand.

<strong>Subject</strong>: ………………………………

⚠️Pro Tip: Keep the silver price fintechzoom chart graph open during market hours to monitor volatility and spot entry or exit points to make profitable decisions.

FintechZoom's Strategic Offerings for Investors

FintechZoom also offers further options to improve your experience investing in silver:

Educational Resources

Read articles, watch videos, follow instructions, and peruse other educational materials to get a deeper grasp of the silver market. For novice investors who are not familiar with the nuances of the precious metals market, this can be especially beneficial.

Investment Calculators

Use resources to determine possible profits on your silver investments. These calculators can assist you in determining how much to invest and help you create reasonable investment objectives by taking into account past pricing data as well as possible future trends.

Community Discussion Board

Make connections, exchange ideas, and gain insight from other silver investors. This can prove to be an advantageous tool in getting fresh viewpoints on the industry and pinpointing possible venture prospects.

Benefits of Silver Price FintechZoom Predictive Analytics

There are various benefits to using FintechZoom’s predictive analytics in your investment plan.

Improved Decision Making

You can purchase, trade, or retain silver with greater knowledge thanks to the insights obtained from predictive analysis. Predicting future price swings can allow you to take advantage of lucrative chances.

Risk management

Predictive analytics can assist you in identifying potential threats and devise strategies to counter them. For instance, you could be asked to adjust your holdings if the model suggests a possible price drop in reaction to upcoming economic data releases.

Better Timing

Predictive analysis makes it simpler to pinpoint possible entry and exit points for silver investments. Depending on when price increases are expected, the model may recommend purchasing or selling before a possible decrease in price.

Streamlined Research Process

The platform provided by FintechZoom accelerates your research process by centralizing all the necessary data and analysis. Because of the time and energy saved, you are free to focus on making smart investment choices.

The Final Note

You can become a more knowledgeable and smart silver investor by utilizing Silver Price FintechZoom tools and insights. FintechZoom can be a helpful ally on your path to investing in silver, but you must conduct your research and make well-informed choices based on your investment objectives and risk tolerance.

You can employ the resources provided by FintechZoom to keep up with the latest industry developments. You can keep up with the ever-changing value of silver and make better, more profitable investments no matter what the market does.