Navigating the Process of Filling Out and Filing the IRS Form 941-X

Navigating the labyrinth of business tax forms can often feel like a daunting task. Among the multitude of forms and regulations, IRS Form 941-X stands out as a critical document for businesses looking to rectify errors in previously reported payroll taxes. But what is this form, and how does it work? In this guide, we will provide you with a clear, step-by-step explanation of how to navigate the process of filling out and filing this form. From understanding the purpose of Form 941-X to breaking down the information you need to complete it correctly, we will demystify the journey of working with this essential tax form. Our goal is to equip you with the knowledge and confidence needed to handle this form effectively and ensure accurate tax reporting for your business. Let’s delve into the world of Form 941-X.

Understanding Form 941-X

IRS Form 941-X, formally known as “Adjusted Employer’s Quarterly Federal Tax Return or Claim for Refund,” is an important document business use to amend inaccuracies on a previously submitted IRS Form 941. Form 941 is a quarterly tax form where employers record payments made to employees, tips received, federal income tax deductions, and both the employer’s and employees’ contributions to Social Security and Medicare taxes.

However, in the intricate world of business operations, miscalculations or oversights can occur, resulting in the need to correct these figures. This is where Form 941-X comes in. It allows businesses to make adjustments to the figures reported in a previously filed Form 941, ensuring accurate representation of their financial situation to the IRS.

You might need to use Form 941-X in various scenarios, including correcting underreported or overreported amounts of wages, tips, taxes, and more. The corrections made using this form can impact not only your business’s tax liabilities or refunds but also your employees’ tax situation.

Required Information for Form 941-X

Before diving into Form 941-X, gathering the necessary information is essential. Here’s what you’ll need to have on hand:

- Employer Identification Number (EIN): This is the nine-digit number assigned by the IRS to identify your business for tax purposes.

- Detailed Payroll Records: You’ll need accurate and comprehensive payroll records that cover the quarter for which you’re filing the correction. This includes wages paid, federal income tax withheld, social security, and Medicare taxes for both employer and employee.

- Original Form 941: The original Form 941 for the quarter you’re correcting is crucial because you’ll need to refer to the amounts previously reported.

- Details of the Error: Clearly identify what was incorrect in the original Form 941. Be prepared with accurate, revised figures whether it was overreported or underreported amounts.

- Employee Consent (if applicable): If you’re correcting overreported taxes that have already been deposited with the IRS and seeking to adjust the social security and Medicare taxes, you’ll need written consent from your employees.

Step-by-Step Process of Filling Out Form 941-X

Filling out Form 941-X may seem intimidating, but breaking it down into manageable steps can make the task more approachable. Here’s a detailed step-by-step guide to help you:

Prepare Your Documentation

Before starting with Form 941-X, gather all the necessary information. This includes your EIN, the original Form 941 for the quarter you’re correcting, detailed payroll records, and, if an applicable, written consent from your employees.

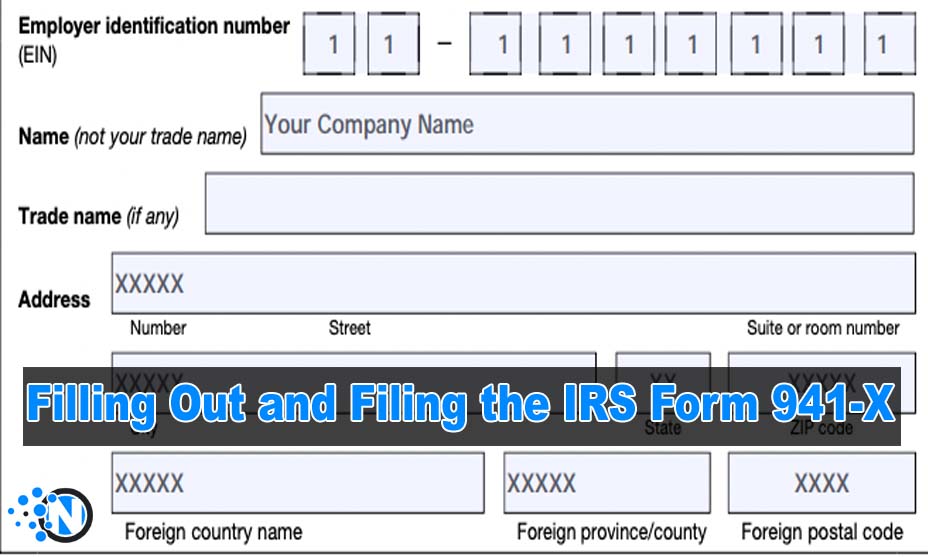

Start with Basic Information

Begin by filling out the top part of Form 941-X with your basic business details. This includes your business name, EIN, and business address. Also, mark the box for the quarter and year the error occurred.

Identify the Type of Error

Form 941-X has separate sections for underreported and overreported taxes. Choose the section that applies to your situation based on the type of error you are correcting. Ensure you read the instructions carefully to choose the correct part.

Correct the Errors

Correct the erroneous figures from your original Form 941 in the appropriate section. You will need to fill out the columns for the correct amount, the previously reported amount, and the difference for each applicable line item. Ensure you follow the form instructions carefully.

Provide an Explanation

You must provide a detailed explanation for each correction you’re making. Use the space on Form 941-X for this purpose. Be concise but detailed, and use additional sheets if necessary.

Review, Sign, and Date the Form

After filling out the form, carefully review all the details for accuracy. Then, sign and date it. Your signature certifies the corrections you’ve made.

Filling out Form 941-X requires attention to detail and precision. If you feel uncertain about any part of the process, it’s always a good idea to consult with a tax professional to ensure accurate completion of the form.

Filing the Form 941-X

Once you’ve completed Form 941-X, the next step is to file it with the IRS. Here’s what you need to know about the process:

Filing Methods

The IRS allows two methods for filing Form 941-X: by mail or electronically. Mailing instructions, including the correct address, can be found in the Form 941-X instructions provided by the IRS. Alternatively, you can electronically file Form 941-X through the IRS’s e-file system. Keep in mind that electronic filing might require you to use a tax professional or purchase suitable software.

When to File

The timing for filing Form 941-X depends on the type of error. It’s best to file underreported taxes as soon as you discover the mistake to avoid potential penalties and interest. For overreported taxes, you have up to three years from the date the original Form 941 was filed, or two years from the date you paid the tax, whichever is later.

Payment

If you’ve underreported tax, you generally need to pay the additional amount due when filing Form 941-X. Various payment methods are available, including Electronic Federal Tax Payment System (EFTPS), check or money order, or credit or debit card.

Tips for Successful Form 941-X Filing

Navigating the process of Form 941-X filing doesn’t have to be daunting. Here are a few tips to ensure a successful filing:

- Keep Accurate Records: Detailed and precise payroll records can make the process of correcting errors much simpler and more efficient.

- Act Promptly: Once you identify an error, act quickly. Early corrections can help avoid potential penalties and interest.

- Double-Check Everything: Double-check all figures and calculations before submitting your Form 941-X. Small errors can lead to larger problems.

- Seek Professional Advice: If the process seems overwhelming, don’t hesitate to consult a tax professional. Their expertise can guide you through the process and ensure accurate filing.

Importance of Timely Filing and Potential Penalties

Filing Form 941-X in a timely manner is crucial. If you’ve underreported taxes, promptly correcting the error can prevent the accrual of penalties and interest. For overreported taxes, you generally have up to three years from when the original Form 941 was filed or two years from when you paid the tax, whichever is later.

Penalties can be quite significant, making correcting errors as soon as you identify them all the more important. Late filing can lead to penalties of 5% of the unpaid tax for each month or part of a month the return is late, up to a maximum of 25%.

Conclusion

Form 941-X, while complex, serves an essential role in rectifying payroll tax errors and ensuring accurate reporting to the IRS. It may seem daunting at first, but the task becomes more manageable by understanding its purpose, knowing the required information, and following a step-by-step approach to filling it out. The importance of timely filing can’t be overstated—acting promptly and accurately can save your business from costly penalties and keep you in good standing with the IRS.

While this guide has aimed to simplify the process, it’s crucial to remember that each business’s circumstances are unique. If you’re unsure or overwhelmed, seeking advice from a tax professional is wise. They can provide tailored guidance to navigate the intricacies of Form 941-X, ensuring your business maintains its financial health and regulatory compliance. So, whether you’re going it alone or seeking professional help, with patience and diligence, you can successfully navigate the process of filling out and filing IRS Form 941-X.