Hedera’s Role in the Future of Micropayments

Micropayments, small transactions of low monetary value, have become an essential part of the digital economy. They provide easy purchases of services, goods, and content in situations when conventional methods of exchange are inconvenient. However, micropayments are difficult for conventional financial systems to operate efficiently. It results in significant transaction costs and delays.

This article explores the applications of Hedera in micropayments and about implementing Hedera micropayments. Hedera’s foresight in micropayments parallels Immediate Edge vision in automated cryptocurrency trading.

What are Micropayments?

Micropayments typically involve small amounts exchanged electronically, often less than a dollar. They are especially relevant in online content subscriptions, pay-per-view services, in-game purchases, and micro-donations to content creators. Micropayments improve user experience and create new revenue opportunities for businesses by enabling cost-effective and real-time payments.

Challenges of Traditional Payment Systems

While traditional payment systems serve well for large transactions, they need more efficiency when processing a massive number of tiny payments. Transaction fees and processing times may be disproportionately high for micropayments. It makes them economically unfeasible for consumers and businesses. The risk of fraud and chargebacks poses a significant challenge to content providers and merchants.

What is Hedera?

Hedera is a third-generation distributed ledger technology that offers a decentralized, fast, and secure platform for various applications. It employs the gossip-about-gossip protocol to achieve consensus quickly, ensuring high throughput and low transaction latency. Unlike blockchain, Hedera’s directed acyclic graph (DAG) structure eliminates the need for energy-intensive mining, further reducing transaction costs.

Applications of Hedera in Micropayments:

Hedera Hashgraph’s many promising uses in the field of micropayments promise to completely alter the way in which we handle monetary transactions of a negligible value online. Let’s look at a few important examples:

Content Creation:

One prominent area where Hedera can make a significant impact is the digital content industry. Micropayments powered by Hedera can play a crucial role in the rise of online publications and the need for sustainable revenue models. Publishers can adopt pay-per-article models, where readers pay a small fee to access high-quality content. Hedera not only helps publishers monetize their offerings but also enables consumers to support the content they value. It helps micro-donations and empowers users to contribute small amounts to their favorite content creators. Hedra promotes a more direct and rewarding relationship between creators and their audience.

Internet of Things:

Furthermore, Hedera has great potential in the Internet of Things (IoT) area, where small payments can facilitate transactions between machines. As devices become more connected and IoT services become more popular, it’s clear that we need smooth and easy microtransactions. It provides a secure and scalable platform for facilitating these transactions, enabling devices to exchange value without the need for intermediaries autonomously.

Payment System:

Implementing Hedera for micropayments requires integration into existing payment systems. Businesses and developers can leverage Hedera’s developer resources and technical considerations to incorporate micropayment functionalities into their platforms seamlessly. Real-world case studies showcase the successful implementation of Hedera for micropayments, high lighting its ability to streamline transactions and provide a frictionless experience for both businesses and consumers.

Scalability:

Hedera’s scalability, security, and low fees make it an ideal solution for powering seamless micropayments, from enabling pay-per-article models and supporting content creators in the digital content industry to facilitating machine-to-machine transactions in the IoT ecosystem. As businesses and industries embrace the potential of micropayments, it pave the way for a future where frictionless transactions at a micro-scale are the norm, driving innovation and enhancing the digital economy.

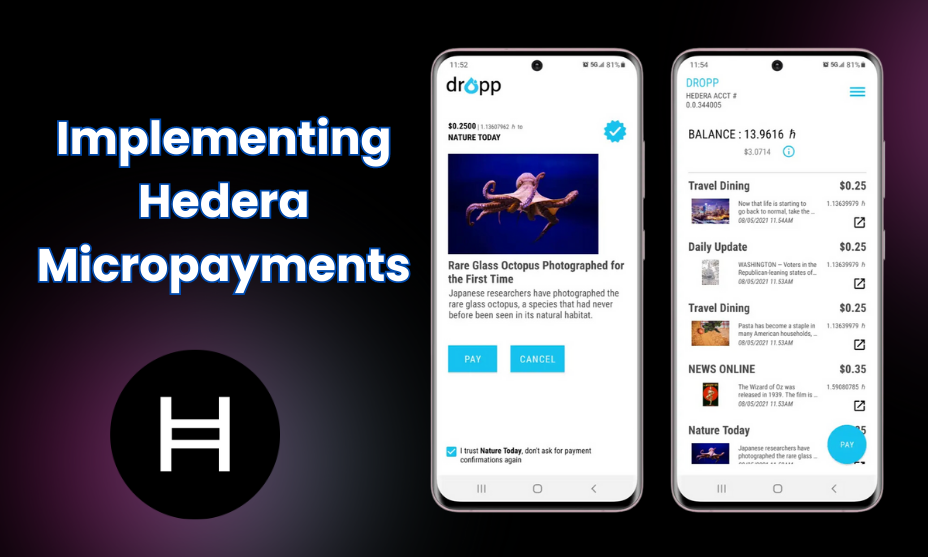

Implementing Hedera Micropayments

Implementing Hedera Hashgraph for micropayments involves integrating the technology into existing payment systems and platforms. By leveraging Hedera’s unique features and developer resources, businesses and developers can seamlessly incorporate micropayment functionalities and unlock the benefits offered by this innovative solution.

Technical Considerations:

To begin the implementation process, businesses need to understand the technical considerations involved. This includes familiarizing themselves with Hedera’s documentation, tools, and APIs. Businesses can gain insights into the technical requirements for integrating Hedera into their existing systems by studying the available resources.

Payment Gateways:

One essential aspect of implementing Hedera micropayments is integrating the necessary payment gateways or wallets. This allows users to transact seamlessly using the Hedera network. Developers can leverage Hedera’s APIs and SDKs to build custom wallets or integrate existing ones that are compatible with Hedera’s network.

User Account:

Another crucial consideration is the establishment of user accounts. Users need to create accounts on the Hedera network to participate in micropayments. This involves generating and managing public and private keys securely. Businesses must prioritize user security and privacy while designing the account creation and management process.

Transactional Aspects:

Businesses need to consider the transactional aspects of micropayments. Its network offers high transaction speeds and scalability and enables businesses to process a large volume of micropayments efficiently. However, implementing appropriate transaction batching techniques or utilizing other Hedera-specific features can further optimize the micropayment process and reduce associated costs.

Testing and Quality Assurance:

Integration testing and quality assurance are vital in ensuring a smooth implementation of Hedera micropayments. Businesses should thoroughly test the integration, including transaction processing, user experience, and security measures. This helps identify and rectify any potential issues before deploying the solution to the live environment.

Case Studies:

Additionally, it is beneficial to study real-world case studies of successful Hedera micropayment implementations. Understanding how other businesses have leveraged Hedera can provide valuable insights, best practices, and lessons learned. These case studies can serve as a reference point for businesses embarking on their Hedera micropayment journey.

By leveraging Hedera’s developer resources and studying successful case studies, businesses can seamlessly incorporate Hedera into their existing payment systems, unlocking the potential of efficient and scalable micropayments. Embracing Hedera Hashgraph empowers businesses to offer frictionless micropayment experiences, driving innovation and enhancing customer satisfaction in an increasingly digital economy.

Conclusion

Hedera Hashgraph has the potential to revolutionize micropayments by offering speed, scalability, and security. As the digital economy continues to thrive, Hedera’s role in facilitating frictionless micropayments across various industries holds great promise. Embrace the future of seamless transactions with Hedera and unlock new possibilities for digital commerce. Its innovative approach to distributed ledger technology holds immense promise for the future of micropayments. Its fast, low-cost, and secure transactions make it a perfect fit for various use cases, from content monetization to IoT transactions and online gaming.