Cash Flow Frog vs. Spreadsheets: Which Is the Smarter Choice for Your Business?

Does managing your cash flow feel confusing, tedious, and full of errors? Traditional cash flow forecasting often feels like juggling too many balls, one wrong move, and everything collapses.

As your business grows, spreadsheets become increasingly outdated, creating more problems than they solve and leading to wasted hours, missed opportunities, and mounting frustration.

This is where Cash Flow Frog can come in to make your finances run smoothly. Their modern tool gives you a better way to manage cash flow smarter, more reliable, and with less stress and inefficiency than spreadsheets.

In this blog post, I will compare Cash Flow Frog vs. Spreadsheets for managing business cash flow and other financial tasks.

Traditional Spreadsheet Forecasting: The Old Guard

For decades, traditional spreadsheet forecasting has been the mainstay in business cash flow management. That’s why spreadsheets are familiar, budget-friendly, and easy to tweak, which many companies still rely on. Nonetheless, their limitations are now only becoming more apparent in today’s rapidly changing business environment.

- Manual and Tedious: Endless data entry consumes time and increases errors, while sharing multiple versions creates confusion and extra work.

- Error-Prone: Nearly 90% of spreadsheets contain errors, which too often result in costly financial errors.

- Poor Scalability: When your business expands, spreadsheets become a pile of chaos that seems almost impossible to organize.

Remember, if your business is growing, your forecasting tools should be growing and upgrading, too.

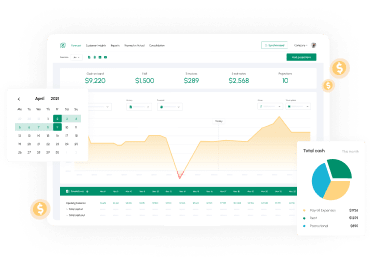

Cash Flow Frog: Your New Best Friend

Cash Flow Frog revolutionizes the financial forecasting application space by combining automation, accuracy, and accessibility into one intuitive platform. Say goodbye to errors, inefficiency, and stress.

Why Businesses Love Cash Flow Frog:

- Automation: Syncs with QuickBooks for real-time updates—zero manual input required.

- Powerful insights: Track current cash flow and forecast future trends with clarity.

- Seamless collaboration: Work from anywhere with cloud-based accessibility.

Switching to Cash Flow Frog removes the guesswork and ensures your financial strategies are always ahead of the curve.

The Ultimate Face-Off: Cash Flow Frog vs. Spreadsheets

When it comes to managing cash flow, the tools you choose can make or break your efficiency and accuracy. Here’s how traditional spreadsheet forecasting and Cash Flow Frog stack up across key areas:

Ease of use: Simple vs. complex

Spreadsheets can be daunting for those without advanced Excel skills. Cash Flow Frog simplifies the process with user-friendly dashboards and straightforward navigation.

Accuracy: Auto-pilot vs. manual entry

Manual data entry in traditional spreadsheet forecasting often leads to errors. Based on a study, 94% of spreadsheets used by businesses in decision-making contain mistakes. For example, ServiceRocket improved efficiency and confidence in decisions by switching to automated forecasting. Tools like Cash Flow Frog eliminate manual errors with real-time data syncing, ensuring accurate forecasts and letting businesses focus on growth.

Time efficiency: Speed vs. tedious

Updating spreadsheets can take hours, especially when juggling multiple data points. Cash Flow Frog reduces this to just minutes, freeing up valuable time for strategic planning. It helps businesses manage finances efficiently and save time for other core tasks.

Collaboration: Instant vs. delayed

With spreadsheets, collaboration often means multiple versions flying back and forth. Cash Flow Frog’s cloud-based platform allows teams to work simultaneously in real time. Team members can collaborate with each other across devices to update data in real time.

Scalability: Ready to grow vs. struggling to keep up

Spreadsheets may work for small businesses but falter as operations expand. Cash Flow Frog scales effortlessly to accommodate growing data demands. Businesses with large data can easily scale up to manage things easily.

Security: Safe and sound vs. risky business

Spreadsheets stored locally or shared via email pose security risks. Cash Flow Frog uses advanced encryption and secure cloud storage to safeguard sensitive financial data.

Here’s a quick summary of how Cash Flow Frog and traditional spreadsheets compare:

| Feature | Spreadsheets | Cash Flow Frog |

|---|---|---|

| Ease of Use | Complex | Simple and intuitive |

| Accuracy | Error-prone manual updates | Automated and reliable |

| Time Efficiency | Time-consuming | Quick and automated |

| Collaboration | Limited | Seamless real-time collaboration |

| Scalability | Limited | Highly scalable |

| Security | Risk-prone | Secure and encrypted |

So, Which One’s Right for You?

Source: Statista

If you rely on traditional cash flow forecasting, it’s time to see if you are serving your long-term goals. 82% of business failures in the US are caused by cash flow issues, emphasizing the importance of accurate and efficient forecasting.

However, businesses are growing quickly accustomed to spreadsheets, and they become bottlenecks.

Here’s a simple list to assist you in making a decision:

- Spending hours on manual updates instead of strategy?

- Losing trust in your cash flow predictions due to errors?

- Frustrated by team miscommunication on shared spreadsheets?

If you answered yes to any of these questions, it’s worth exploring forecasting tools like Cash Flow Frog.

In Conclusion

Traditional spreadsheet forecasting may have been as good as the solutions required in the past, but modern businesses need and deserve more innovative solutions. However, there is an advanced version that saves time, is more accurate, and grows with your business: Cash Flow Frog.

Take the first step toward stress-free cash flow management. Discover how Cash Flow Frog can transform your finances today.