Cash App Canada- Best Cash App Alternatives

Cash App Canada, allows you to send and receive payments instantly, just like Cash App, but it also has some extra features that make it an even better choice for users. Cash App supports both credit cards and bank accounts as payment methods, so you can choose the most convenient. Cash App also has a built-in budgeting tool that can help you manage your finances and stay on top of your spending. You can set up recurring payments to save time, and Cash App’s customer service is always there to provide help if you need it.

Does Cash App Accessible in Canada

Cash App is a versatile platform that allows you to send and receive money, as well as other features like direct deposits, trading in stocks, and buying bitcoin. Although popular in America and the United Kingdom, Cash App is not accessible for use internationally. The company has yet to make any announcements about expanding its services to Canada. Consequently, you’re unable to send or receive money from anyone living in another country.

Cash App Canada is not available, but there are many Cash App alternatives in Canada that can help you with your payments and money transfers.

Alternatives to Cash App Canada

Interac e-Transfer

Interac is a Canadian payment network that offers a secure way to send money online and through the mobile banking app. The recipient will receive an email notification with instructions on how to pick up the funds, which they can then deposit into their bank account. Interac e-Transfer is the easiest and most convenient way to send money in Canada without having to download an app.

Interac e-Transfer is a safe and easy way to send money to anyone in Canada with an email address, phone number, and bank account at one of its 250+ participating institutions. Although there are ordinarily no charges for receiving money, some institutions may charge a small fee. On the whole, Interac e-Transfer is speedy and straightforward.

PayPal

PayPal is an international payment platform that you can use to send and receive money around the world. It also offers a wide range of features such as merchant services, payment processing and money transfers. While Cash App is not available in Canada, PayPal can be used by Canadians to send and receive money from friends and family around the world. PayPal offers a convenient way to send and receive money both domestically and internationally. In addition, PayPal also owns Venmo, which competes with Cash App in the U.S. market.

PayPal is easy to use, secure, and highly reliable. However, PayPal charges a fee when you send money internationally, so it is not always the best way to go if you are in need of sending money abroad. With over 300 million users worldwide, it’s probable that your intended recipient has access to Paypal.

KOHO

KOHO is a Canadian digital banking platform that offers Cash App-like features such as money transfers, budgeting tools, and rewards. It is a platform that allows you to save money, budget, get cash back and improve your credit score. With KOHO, you can instantly send and receive money to family members and friends. The recipient will receive an email notification with instructions on how to pick up the funds. The money can be deposited into their bank account, or they can withdraw the money from an ATM. KOHO charges no fee for sending and receiving money, making it a great Cash App alternative in Canada.

KOHO also offers a dependable prepaid card that allows you to manage your money more efficiently. You load the amount of money you want onto the card, meaning you can never spend more than what’s available. And to sweeten the deal,

will give you a $20 bonus when signing up for their services.

Newton

If you’re looking to invest in Bitcoin or other cryptocurrencies, Newton is the place for you just like Cash App. With low fees (including hidden fees), over 75 different coins available, and free e-transfer deposits and withdrawals, Newton makes it easy to get started in the cryptocurrency market.

Newton also offers features such as banking, investing, payments, and more. The Cash App alternative in Canada allows users to effortlessly buy and sell cryptocurrencies, set up recurring investments for passive income, and receive real-time price updates. It also offers a Cash Back feature that rewards users in the form of Bitcoin Cash.

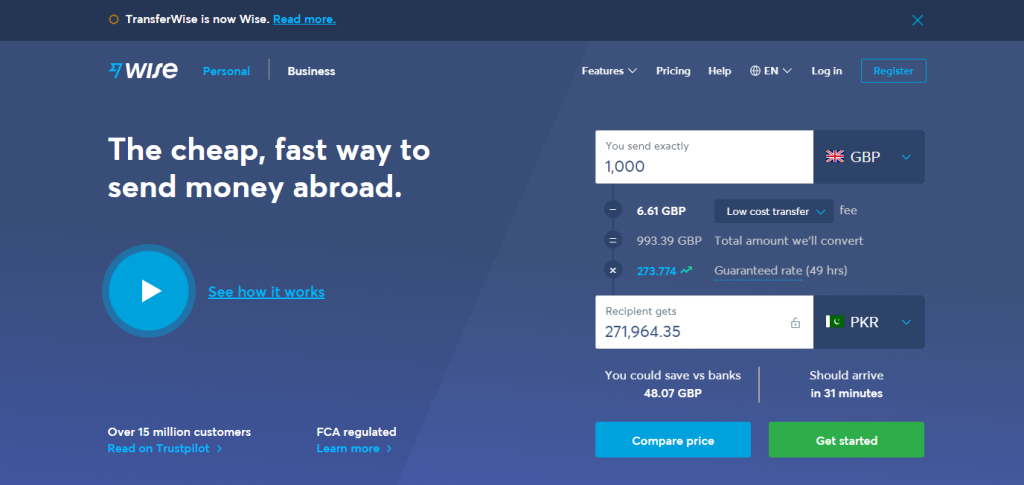

Wise

Wise is a money transfer service that allows you to send and receive money in over 80 countries. With Wise, you can get the real exchange rate, which means you’ll always know how much your recipient will get – no hidden fees or charges. This way, you’ll be informed of the fee prior to opening an account or sending money. Furthermore, Wise also offers a multi-currency account that allows you to manage money in multiple currencies.

Wise is fast and secure, and it’s an excellent Cash App alternative for Canadians. The money is usually delivered within 1-3 business days, and you can track your payment in real-time. It is also backed by the Financial Services Compensation Scheme (FSCS), so you know that your money is safe and secure with Wise.

Wealthsimple Cash

Wealthsimple Cash is a Cash App-like app that offers a no-fee chequing account and digital debit card. It also has a Cash Back feature that rewards you for using your card. Cash back is deposited into your Wealthsimple Cash account, and it can be used to make purchases or transferred to a bank account.

Not only can you instantly send and receive money from your loved ones, but you can also earn 5% cash back on all of your purchases. And with free e-transfer deposits and withdrawals, Wealthsimple Cash makes it easy to manage your money. The company has over 2 million users in different countries. When you create a new account, you will automatically receive a bonus.

Conclusion

These alternatives can be called Cash App Canada Apps as Cash App is not available in Canada. These Apps provide users with an opportunity to instantly send and receive money from family and friends, budget and save money, and access Cash Back rewards. Each alternative offers its own unique features, so it’s important to compare the different options before signing up. These alternatives also provide users with more flexibility and control over their money, making them great Cash App alternatives for Canadians.