Auto Industry Trends – How To Improve Your Car Buying Experience

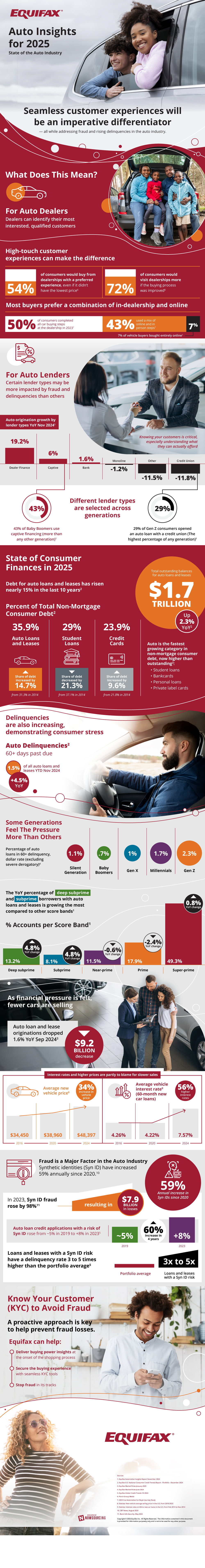

In 2025, the cost of getting a new car can be outrageous. Since 2016, the average price for a new vehicle has grown 34%. During the same timeframe, the average new vehicle interest rate for a 60-month loan went from 4.26% in 2016 to 7.57% in 2024.

This comes alongside other factors that cause financial pressures on consumers. Since 2014, the share of consumer debt for auto loans and leases went from 31.3% to 35.9% or a growth of nearly 15%. This means the total for all outstanding auto financing agreements has reached $1.7 trillion, which marks a 2.3% growth. These factors combine and can make it difficult for consumers to afford a new car.

Understanding Current Automotive Trends

Therefore, these financial pressures can lead certain customers to misrepresent their actual financial status. Synthetic identities (Syn ID’s) have seen a massive rise since 2020, showing a 59% annual increase. Customers will use these Syn ID’s to conceal facts about their buying power or financial status.

It has become so prevalent that the risk of an auto loan credit application went from around 5% to over 8% in just 4 years. These fraudulent applications have a delinquency rate between 3 and 5 times higher, and cost around $8 billion in losses alone.

Conclusion

So, how can you protect your dealership against this growing new method of fraud? Companies now provide Know Your Customer (KYC) technology that lets you glimpse the true financial status of customers. This technology allows you to proactively check the true buying power of a customer while they are still shopping around for cars.

They even help to streamline the buying process to make it easy for your verified customers to buy. Regardless of what kinds of cars you sell, taking advantage of Equifax can help make sure your customers better enjoy the buying experience. Learn more about current auto industry trends in the infographic below: