Due to the demands and requirements of the people, the banks have introduced their banking mobile applications to facilitate their all users. These banking apps have made very easy and simple the transfer of money anywhere in the world from any location.

The Canadian government has introduced a very user-friendly mobile banking application, Motive Financial. This mobile app is a wonderful option for anyone looking for online banking solutions. People are managing and controlling their financial assets through this mobile application.

Mobile banking applications enable people secure transactions. There are no chances of any loss or financial fraud. Throughout the world, people conveniently download and log in the mobile banking apps and used them from their homes to do instant transactions of money.

What is Motive Financial Mobile App?

It is a Canadian banking application that is used by individuals in Canada. This mobile app was developed in 2008. Recently, this app was rebranded and updated by Canadian Western Bank in 2017.

The headquarters of this online mobile app is in Edmonton which is the beautiful city of Alberta in Canada. It has also opened its branches in Lahore, Buffalo, India, America, and Vancouver. Motive provides its users to save their money with very high-interest rates.

Because this mobile banking app exclusively operates online, users can benefit from better rates and lower fees by saving more money.

Because of the excellent services of Motive Financial, it has become the top mobile banking application in Canada. Motive charges a very low fee for making transactions. It facilitates the people with its tremendous services and financial products.

People can access it easily from their location 24/7. People can also exchange money through this mobile app and it charges a very low cost for cash exchange.

The Motive has an ATM or Card for the convenience of its users and its ATM is free for every user. People can pay their bills, fees, online shopping, utility bills, college and university dues, and much more. A large number of industries are using its services.

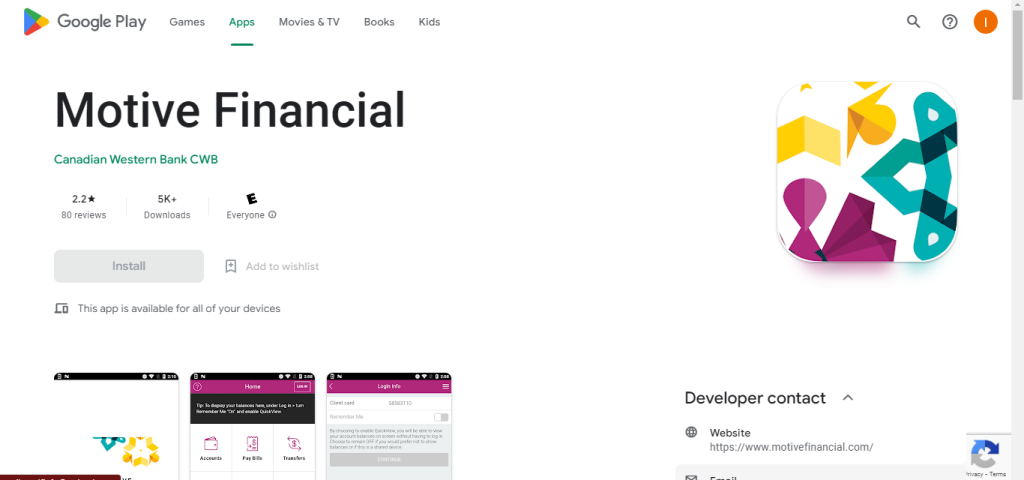

Google Play Store Downloads: Motive has more than 5k downloads on the Play Store.

Is Motive Financial Safe or not?

It is a very secure mobile banking application. It is developed according to the standards of the Canadian Western Bank. You can safely use this app for your transactions and general use. This app also enables users to lock their account on Motive to extra secure their money. This mobile app is very safe to use.

Features

The characteristics of Motive are beneficial for its users. Because of its useful features, people all over the world enjoy using it.

Customer support

Motive offers a variety of services for customer support. The app’s home page consists of the Help Center option, which people can contact for any sort of issues or queries related to the app. The developer has also added a mobile number and an email account to solve user queries.

Integration of Digital Wallets

The most important feature of this mobile software is the integration of digital wallets with it. People can integrate other commonly used digital wallets with their Motive account to make transactions conveniently.

Safety of Drivers

The features of Motive Financial include the AI dashcam. By using this AI dashcam, drivers can drive safely the car and protect themselves from accidents and traffic rules violations. Furthermore, this app offers users automated coaching for the safety of the driver.

Saving Account

Motive provides its users with very high-interest saving accounts. It allows it’s all users to earn money from their savings deposits.

Pay Your Bills and Dues

Through this wonderful Canadian mobile banking application, people can pay their utility bills, shopping bills, grocery bills, and dues for their education from the comfort of their homes.

Dispatch Management System

A proper products and items dispatch management system is also offered by Motive to users. People can use this feature for tracking the delivery of their ordered products.

Tracking

People can utilize the features of this mobile app to track their asset usage, equipment, and location. User can also track their transaction history.

Send and Receive Cash

Through this application, people can make remote transactions. Users can send and receive cash throughout the world.

Top Alternatives of Motive Financial

The best alternatives to the Motive mobile banking app are listed below:

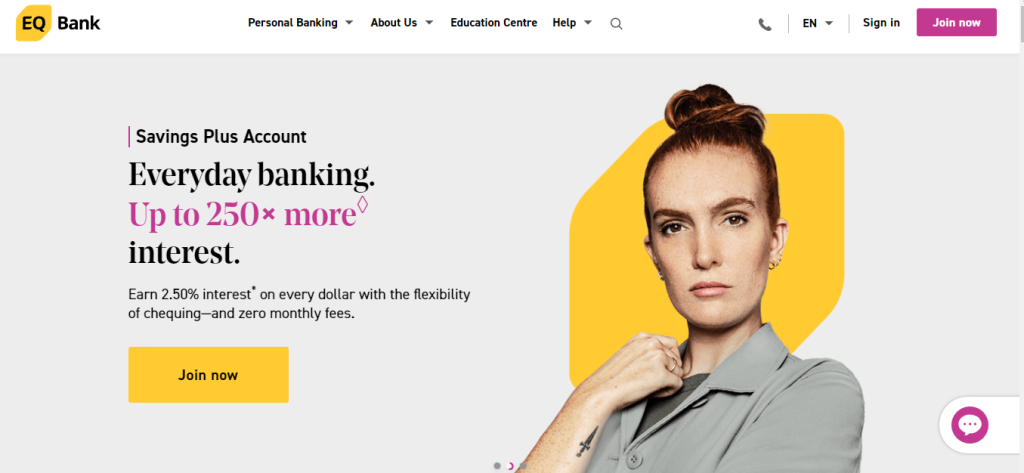

EQ Bank

It is the best digital banking app, which was developed in 2016, that charges zero fees for making transactions. EQ Bank is considered one of the top 10 best and largest domestic banks in Canada. EQ banking app developed by Equitable Bank. This banking is also based on the subsidiary of Toronto.

The EQ Banking app is designed according to public demands. This banking app has no physical offices. The EQ mobile banking application has a feature for investment services and borrowing services against mortgages. It provides its customers with savings accounts.

Neo Financial

This is regarded as the best financial investment and savings mobile banking application in Canada. The Chief Executive Officer and Co-Founder of Neo Financial is Andrew Chau, whose objective is to serve the Canadian people by investing their money in the right place.

The Neo Financial services include bill splitting, payments, buy now and pay later, and safe credit. The products of this banking software are Neo Mortgage, Neo Cards, Neo Invest, and Neo Money.

Simplii Financial

This is a digital mobile banking app which is introduced in 2017. Simplii Financial offers people credit cards and borrowing services. It helps people in managing their cash and also free money transfers.

Simplii Financial was introduced by the Canadian Imperial Bank of Commerce. It now serves more than two million customers. Additionally, Simplii is also providing mortgage services to its users.

Tangerine

This is a personal banking app designed for people’s convenience. Tangerine is developed by Gillian Riley. This mobile banking app is founded in 1997. Scotiabank has introduced this banking application. Tangerine’s headquarter is located in Toronto, Canada.

Tangerine provides users with mutual funds, zero-fee transactions, and investments. It provides its clients with valuable products and services. It provides ATMs to its users.